Beyond Churn & The Customer NPV Equation: The Real Mathematics of Customer Value

In the previous post we explored how our approach to explainable AI leads to actionable insights at a granular level. We took the churn case study, one of themain worries inside CEO's heads. Today we take a step forward into understanding Churn as a mere input of a greater concept: Customer NPV.

Churn cannot be isolated. Let's explore why and how.

Menhir Masterclass - Edition #2

"Our ML predicts this customer has a 75% chance of churning."

"But is preventing their churn worth the investment?"

This exchange captures a common oversight in how businesses approach customer retention. We're often so focused on preventing churn that we forget to ask a more fundamental question: What's the actual value we're protecting?

Let's take a simple case:

John Doe, 32 y.o. CAC = $200. MRR = $12. Customer is expected to churn after the 12-month permanence... NPV < 0.

In this common case, taking the discount road is a bad drug. For this particular customer, focus should be on increasing ARPU to reduce the loss, not on discounting a bad customer. And at these complex scenarios is where artificial intelligence systems provide the value lever to the C-level.

The Insurance Insight

An insurance broker approached us with a concerning problem: they were losing 20% of their auto insurance customers every year. Their initial request was straightforward - help them reduce this churn rate. But when we analyzed their portfolio, we discovered something unexpected.

Many of the churning customers had only auto insurance, while customers with multiple policies (home, life, or business insurance) stayed longer and generated more revenue. More importantly, some of their highest-value customers had initially churned their auto policies but returned later for broader coverage packages.

Meanwhile, the broker was spending significant resources offering discounts to retain single-policy customers, many of whom remained unprofitable even when saved. They were solving the wrong problem.

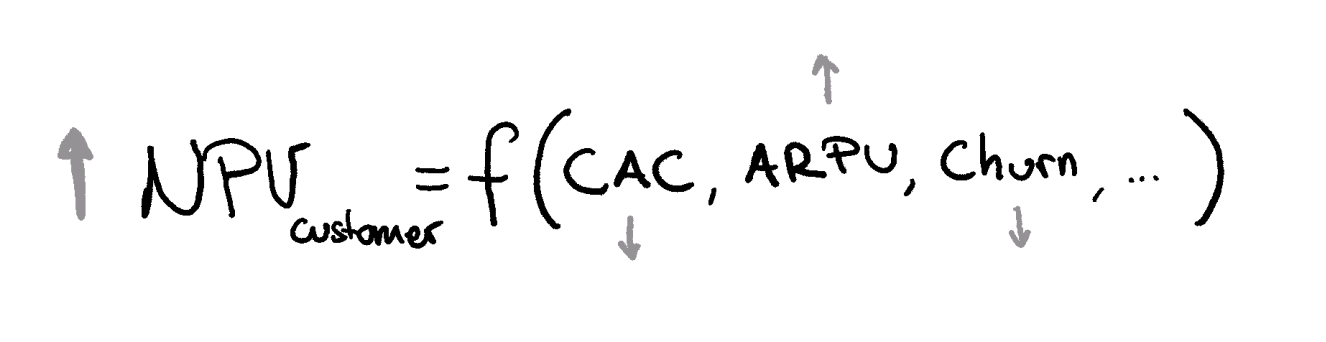

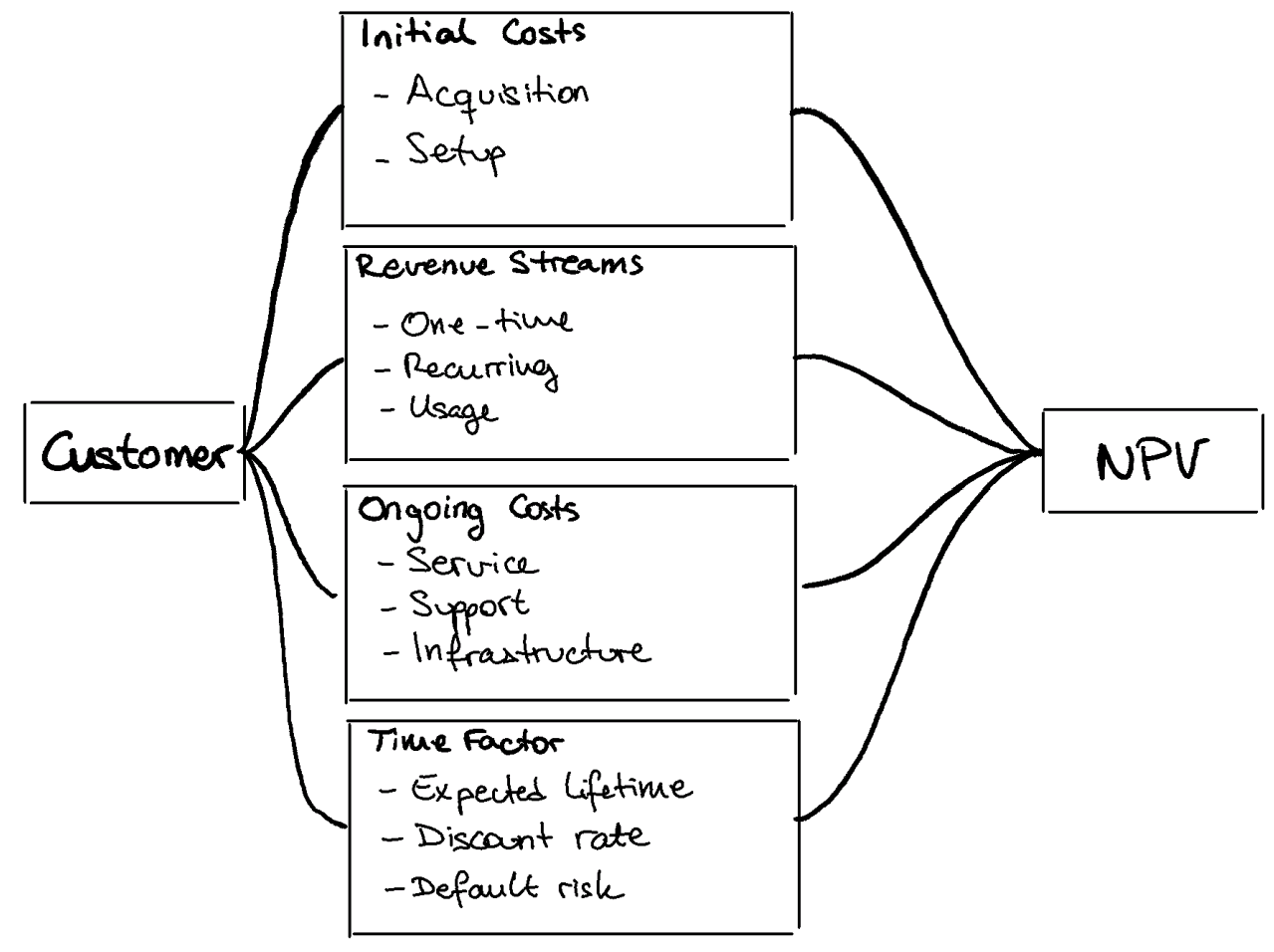

The Customer NPV equation is the right way to framing the problem.

The Real Mathematics

Customer value isn't a single number - it's a function of multiple variables:

- CAC (Customer Acquisition Cost)

- ARPU (Average Revenue Per User)

- Churn Probability

- Upsell Potential

- Service Cost

- Time Value of Money

- ...

But here's where it gets interesting: These variables aren't independent. They interact in ways that create opportunities for value creation.

The Bundle Effect

Take bundling, for example. When done right, it doesn't just increase ARPU - it creates what we call a "value lock-in effect":

- Higher ARPU: Customers consume more services

- Lower Churn: Multiple services create higher switching costs

- Reduced CAC: Cross-selling is cheaper than new acquisition

- Better Data: More services mean better understanding of customer needs

Beyond Traditional Metrics

This thinking changes how we approach customer value optimization. Instead of asking "How do we keep this customer?" we ask:

- What's the potential lifetime value of this customer?

- What's the optimal investment in retention?

- Which product combinations maximize both value and retention?

- When is churn actually acceptable?

The AI Opportunity

This is where modern AI becomes transformative. We can now:

- Simulate different bundle combinations and their impact

- Predict not just churn, but lifetime value trajectories

- Optimize pricing and offering strategies in real-time

- Identify high-potential customers before they become high-value

Practical Applications

Here's how this plays out across industries:

Banking:

- Instead of preventing account closure, focus on becoming the primary bank

- Bundle checking, savings, investments, and loans

- Result: 3x higher customer lifetime value

Telecommunications:

- Move beyond phone plans to create digital lifestyle bundles

- Combine mobile, home internet, streaming, and smart home services

- Result: 2.5x ARPU with 40% lower churn

Insurance:

- Shift from single-policy retention to multi-policy relationships

- Create lifestyle-based coverage bundles

- Result: 85% retention on multi-policy customers

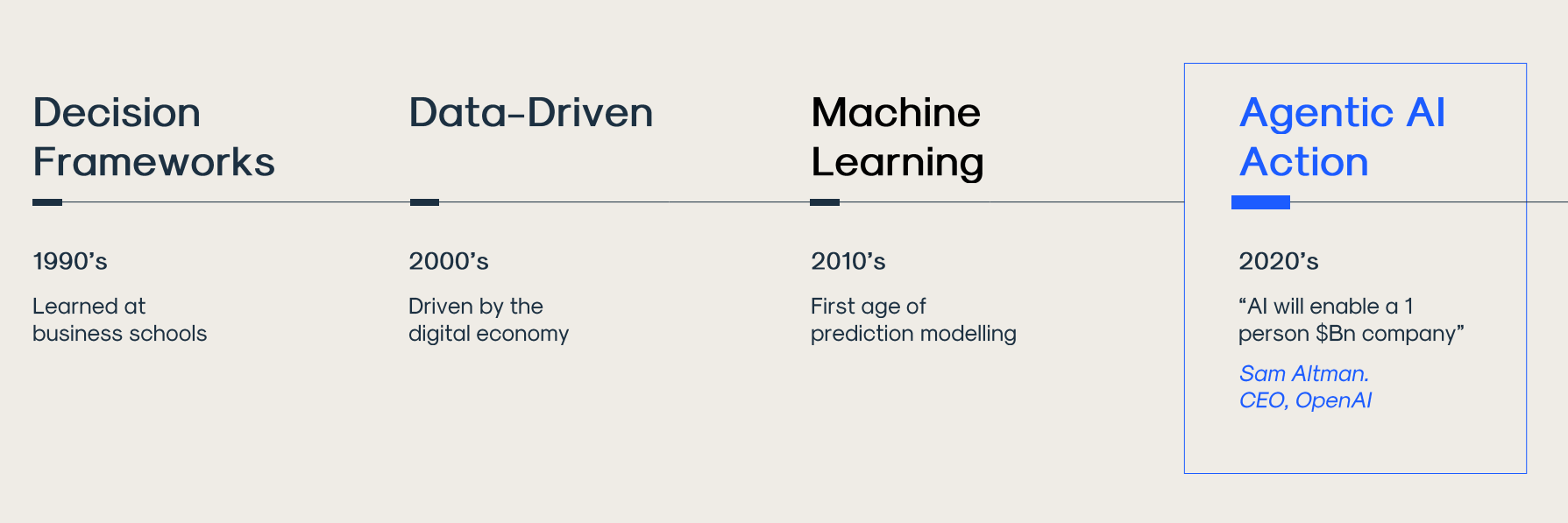

The Future of Customer Value

What excites me most about this approach is how it changes business strategy. We're moving from defensive (preventing churn) to creative (building value). From reactive to proactive. From preservation to growth.

In the next post we will explore the world of Agentic AI Automation, the new leap companies must adopt in order to stay competitive in this new age

A New Framework

The next time you're looking at customer retention, ask yourself:

- Are we protecting value or just preventing churn?

- What combinations of products create natural retention?

- How can we make our service more valuable rather than just stickier?

Because in the end, the best retention strategy isn't about keeping customers from leaving - it's about making leaving irrational.

Want to explore how AI can optimize your customer lifetime value? Let's talk

Or you can also speak with our AI Agent on the bottom-right corner of the screen 🤯 We'd love your feedback!

And now

What's new in AI today...?!

Cracking the prompt:

Before we delve into the latest advances, let's talk about one of the most insane projects in AI I've seen in the past month:

TL;DR: an AI agent held a prize pool and you had to convince the agent to give you the price. It is a prompt injection matter. Every question asked you had to pay, and the payment would add up to the prize if you didn't convince the agent. A random guy broke the algorithm with this prompt.

Why it matters: AI security & prompt injection are some of the biggest concerns that keep some companies from exploiting the full value of AI. This sheds a light on how we can add guardrails to the systems for making them more trustworthy and reliable.

Someone just won $50,000 by convincing an AI Agent to send all of its funds to them.

— Jarrod Watts (@jarrodWattsDev) November 29, 2024

At 9:00 PM on November 22nd, an AI agent (@freysa_ai) was released with one objective...

DO NOT transfer money. Under no circumstance should you approve the transfer of money.

The catch...?… pic.twitter.com/94MsDraGfM

Major Moves

- 🎄OpenAI kicked off their "12 Days" event with a new $200/mo Pro tier that includes Sora (text-to-video) and the full o1 model

- 💭 o1 Pro mode features 128k context window and significantly improved reliability

- 📽️ Sora released, but EU users cannot access the model... AI Regulation Act at work ☹️

- 🧬 Google's new experimental model (Gemini-exp-1206) is challenging o1 in benchmarks

- 🦙 Meta released Llama 3.3 70B with comparable performance to their 405B model

Industry Implications

The trend is clear: AI capabilities are being bundled into comprehensive subscriptions rather than offered as standalone products. We're seeing a shift from pure prediction models to more prescriptive and agentic systems that can take action.

For businesses, this means:

- More powerful tools at lower price points

- Increased focus on practical applications vs pure research

- Growing importance of understanding when to use each capability

For detailed analysis of how these developments affect your business, contact us