AI Enabled or AI Enabler: The New Business Divide

Inside Menhir Series - Edition #1

The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation.

This statement, recently highlighted by a16z, perfectly captures the transformative moment we're experiencing in the business world. But there's a crucial nuance we need to discuss: it's not just about startups versus incumbents anymore. It's about who becomes an AI enabler and who becomes AI-enabled business.

Let me explain why this distinction matters.

The New Business Paradigm

Five years ago, when we started Menhir AI, we faced a critical decision: should we become a "NeoServicer" disrupting traditional financial services, or should we focus on enabling existing servicers with AI capabilities?

The answer came from understanding a fundamental truth about AI transformation: the value of existing business infrastructure and relationships is immense. The cost and complexity of building new distribution networks often outweigh the benefits of starting fresh. Instead, we chose to become an AI enabler, helping established servicers transform into "NeoServicers" through our technology.

Today we serve some of the largest Financial Services institutions in the world, reimagining their capabilities through our value creation focus as a category leading AI Enabler. We stand with the incumbents, helping them navigate the AI turmoil.

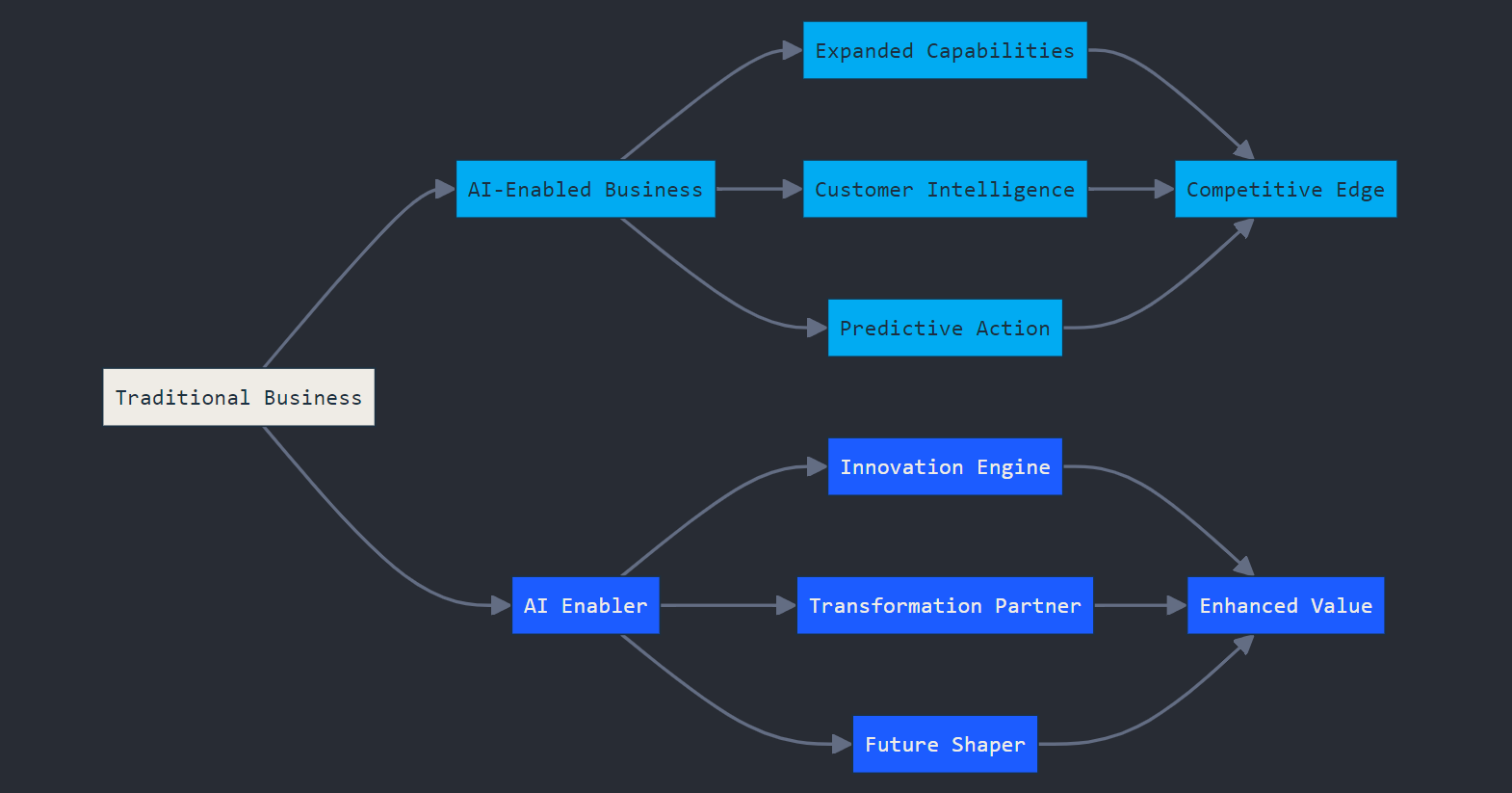

This decision shaped our understanding of the market: In the AI age, businesses will fall into two categories:

- AI Enablers: Companies that create and deploy cutting-edge AI technology, helping others transform their operations.

- AI-Enabled Businesses: Companies that leverage AI to enhance their core operations, achieving greater margins and competitiveness.

When Reality Meets Theory

The real power of this divide became clear to me during a meeting with a major European loan servicer's leadership team. They were competing with new fintech players in their loan servicing business. The fintech had a modern tech stack, and aggressive growth. But what they didn't have was two decades of customer relationships, deep market understanding, and established distribution channels.

We helped the loan servicer turn these advantages into their AI transformation cornerstone. Instead of trying to become a fintech, they became something more powerful: a traditional loan servicer with AI superpowers. Their collection rates didn't just improve – they almost doubled, while lowering cost-to-serve by ~40%. But more importantly, they did it while maintaining the brand, trust and relationships they'd built over years.

This pattern kept repeating across industries. A real estate broker wasn't just selling properties anymore – they were using AI to understand and optimize every aspect of their funnel and portfolio. An insurance company transformed from reacting to customer churn to preventing it before it happened.

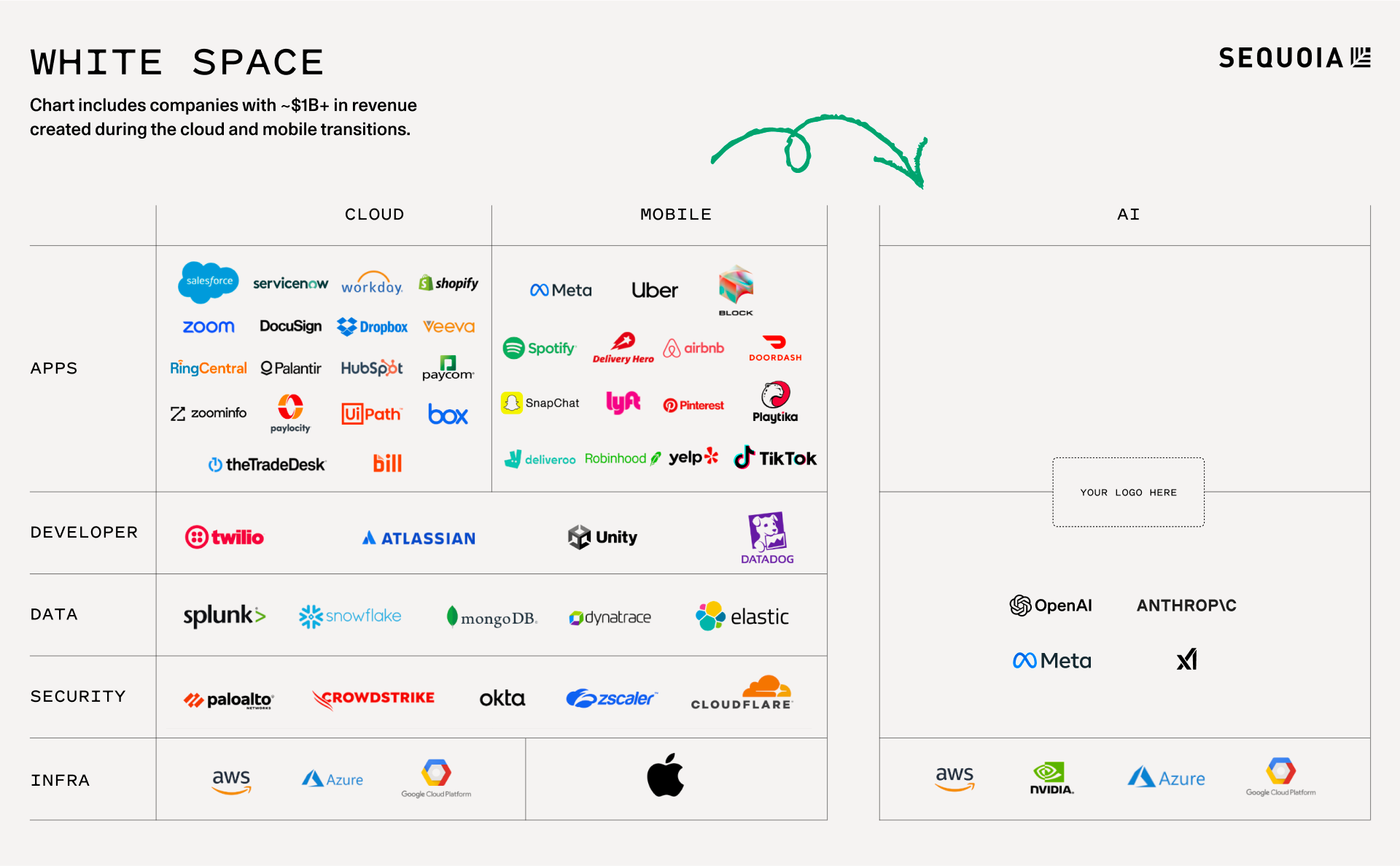

From Sequoia's "Generative AI's Act o1":

The Market Evolution

What we're seeing isn't just digital transformation rebranded. It's a fundamental shift in how businesses operate. Insurance companies using AI aren't just processing claims faster – they're creating personalized engagement strategies for each customer. Real estate firms aren't just listing properties – they're optimizing pricing and visibility across every channel in real-time.

The difference between AI-enabled and traditional businesses isn't just about technology. It's about capability expansion. Imagine playing chess but being able to see ten moves ahead while your opponent can only see two. That's what AI enablement does – it expands what's possible while building on existing strengths.

The Wake-Up Call

Here's the uncomfortable truth: competing against an AI-enabled business without being AI-enabled yourself is like bringing a calculator to a supercomputer fight. The playing field isn't just uneven – it's fundamentally different.

A bank using traditional credit scoring isn't just at a disadvantage against one using AI – they're playing an entirely different game while competing for the same leads. The AI-enabled bank isn't just making better decisions; they're making decisions that weren't even possible before.

The Path Forward

For incumbents, the message is clear: the time to become AI-enabled is now, before AI-native startups gain distribution. The good news? You don't have to build everything from scratch.

That's where AI enablers like Menhir AI come in. We've seen that the most successful transformations happen when established companies combine their domain expertise and market presence with cutting-edge AI capabilities. It's not about replacing what works – it's about enhancing it.

A Personal Note

Here's something interesting: even as an AI enabler, we're experiencing this transformation first-hand. Every day, AI tools reshape how we create technology. We're not just observers of this revolution - we're at its cutting edge, or as we say in Spanish, the "punta de lanza".

Just yesterday, I built a complete time-tracking system using AI in minutes - something that would have taken weeks before. This isn't just about coding faster; it's about expanding what's possible. We're seeing our own capabilities multiply through AI enablement, even as we enable others.

This raises fascinating questions about the future of software development and business transformation. When should companies build their own AI solutions, and when should they buy? How is AI changing the traditional build vs. buy equation?

The questions we're all facing aren't just about whether to adopt AI – they're about how to ensure we're on the right side of this great business divide. In the coming posts, we'll explore the technical, practical, and strategic aspects of this transformation.

Because in the AI age, the question isn't whether to transform, but how to do it while building on your existing strengths.

Want to explore what this means for your business? Let's talk ☎️